Meme Coin News: Roaring Kitty Returns to Twitter and CHEWY Price Reacts

Meme Coin News: Market Highlights

The meme coin market capitalization has increased by 3.4% over the past 24 hours to $39.4 billion.

Not many coins are in the red today.

At the top of the red list we find Drunk Chicken Centipede (DCC), with a 24.2% drop to $0.0006161.

Neiro (NEIRO) also recorded a double-digit loss: nearly 16% to the price of $0.00004774.

The rest of this list saw drops below 9% per coin.

Looking on the green side, we find that BOBO Coin (BOBO) saw the highest increase of 39.9%, followed by Monkey Pox (POX)’s 23.3%, Doland Tremp (TREMP)’s 19.6%, Neiro on ETH (NEIRO)’s 14.4%, and Wojak (WOJAK)’s 14.3%.

Several other coins saw double-digit increases.

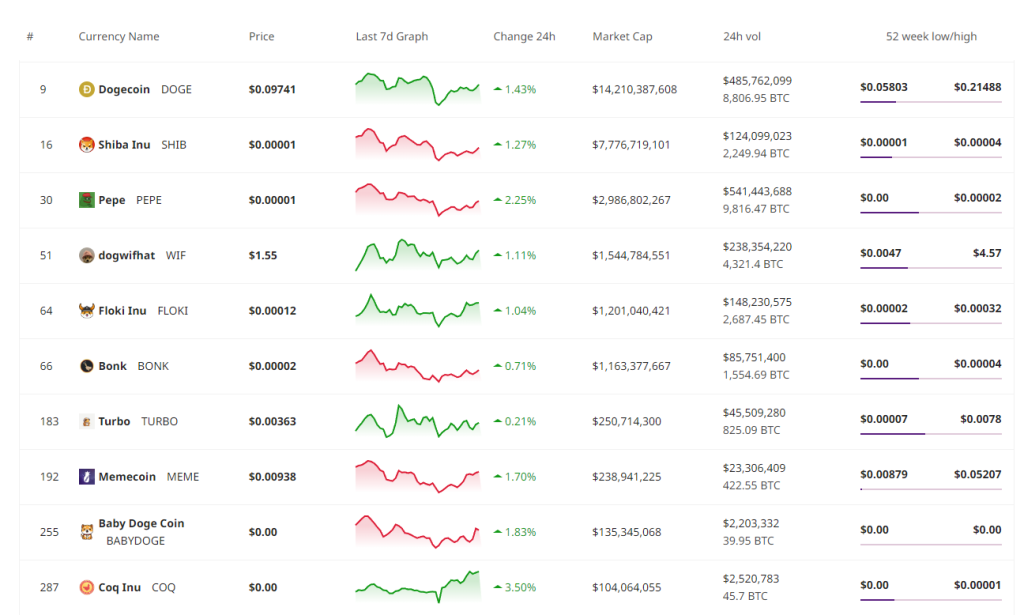

Now, turning the focus on the top 10 meme coins per market cap, we find all of them green.

Coq Inu (COQ) is the day’s winner, with a 3.5% increase, followed by Pepe (PEPE)’s 2.25%.

While a couple of coins are up below 1%, the majority has appreciated 1%-2%.

The top meme coin per market cap, Dogecoin (DOGE), recorded a 1.43% increase, trading at $0.09741.

The second largest coin is Shiba Inu (SHIB). It’s up 1.3%, currently changing hands at $0.00001.

CHEWY Tokens React on Roaring Kitty’s Latest Post

In meme coin news today, trader Keith Gill, known as Roaring Kitty, known for sparking the GameStop frenzy, recently published a post that may suggest he is not supporting the pet product company Chewy, with the Solana-based meme coin immediately reacting.

After more than two months of Twitter absence, Gill shared a picture on September 6, showing a scene from the popular movie Toy Story, when Andy drops Woody – except that in Gill’s post, Woody’s face was replaced with the Chewy logo.

In June, Gill revealed a 6.6% ownership in Chewy. In the same US SEC filing, he declared he is not a cat.

Given that so many people are watching Gill’s every move following the GameStop saga, it’s not surprising that Chewy meme coins followed the disclosure.

Yet, this latest post seems to indicate he is dropping the company.

Looking at the performance of two CHEWY (CHWY) coins, we find that both spiked on September 6, albeit very briefly.

While one appreciated 6% in the last 24 hours, the other fell 10% in a day.

Both saw drops over the past week and month. The former is down 5% in 7 days and 36% in 30 days, while the latter fell 12% in one week and 34% in one month.

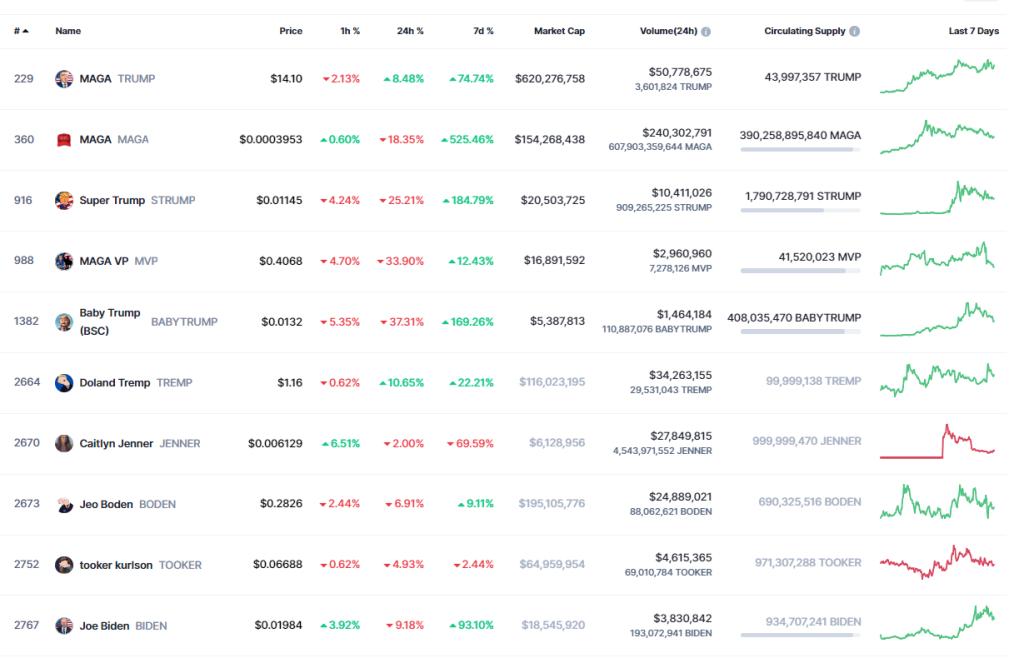

PolitiFi Coins’ Market Cap Cut in Half in 2024

Political finance (PolitiFi) coins, as a subsection of the larger meme coin sector, have recorded a significant market capitalization drop over the past four months.

As a reminder, these coins are related to political figures, entities, events, or movements, but are not connected to or created by them.

Nonetheless, real-world events affect the coins’ price movement.

Some of the most popular PolitiFi meme coins currently relate to the upcoming presidential elections in the US, more specifically, the candidates: current Vice President Kamala Harris and former President Donald Trump.

That said, despite the elections approaching in November, the overall market capitalization for these coins has been dropping.

The earliest available snapshot for this year is May 30, when the market cap stood at $816.64 million.

Yet, at the time of writing, that number stands at $485.6 million.

This is a significant $331 million decrease.

We notice that Trump-related coins have remained prevalent in the top 10 coins per market cap over the past few months.

ConstitutionDAO (PEOPLE), however, has taken the first spot recently, pushing MAGA (TRUMP) down.

The project shut down in June last year, saying it “has run its course” and refunding the contributors. However, it has maintained its lead over the PolitiFi scene.

Community Takeover Teams May Face Legal Issues – Report

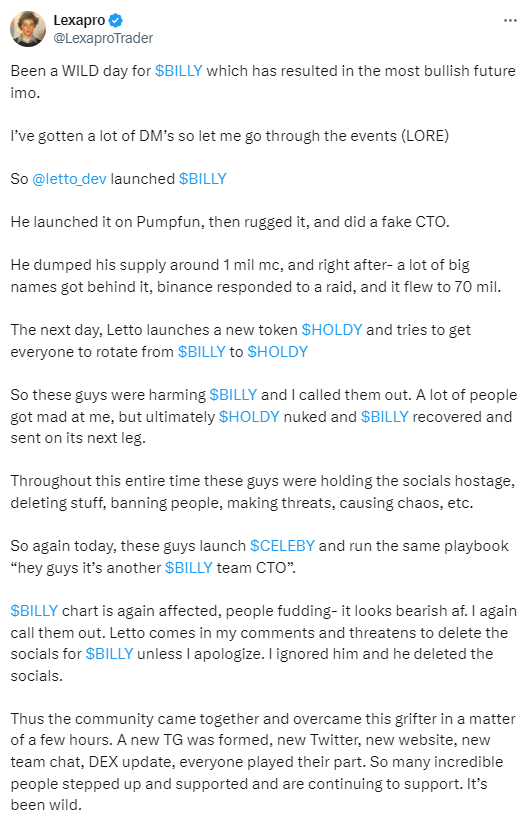

In other meme coin news today, we analyze why community takeovers (CTOs) have been all the rage this year.

Community members – often early investors – have taken over several projects and managed to push the coins’ prices higher.

This happens after developers/token creators abandon a project.

However, some experts warn that CTO teams may see significant legal problems.

According to Charlyn Ho, founder and managing partner at Rikka Law, as reported by Decrypt, one of the biggest dangers for CTO teams is “going to be misleading marketing, unfair or deceptive trade practices, or maybe even criminal misrepresentation or fraud.”

It is essential that they explain the project clearly and not overhype it so to avoid any form of deception.

Ho remarked that some of the issues seen in the courts “have alleged the founders of these projects, for example, have claimed that their coin was backed by a huge community of investors, but they knew it was not.”

The teams also face intellectual property (IP) issues, given that there was no official power transfer.

The token creators still own the name, image, likeness, and other rights associated with the project. For example, this can be a specific dog or cat image, warned Andrew Rossow, attorney and CEO of AR Media.

At the same time, attorney Jacob Martin argues that serious legal action is unlikely due to the speculative nature of meme coins.

“It sure seems like meme tokens are going to face far less scrutiny as they are a bit clearer in the facts of where they sit in the stack,” Martin said.